Page 21 - MWC 3-9-2023s

P. 21

Midwest Cattleman Magazine

for the first time in the year. The Midwest Cattleman · March 9, 2023 · P21

Spring 2023

The largest year-over-year

decrease was in exports to

China, down over 36%, fol-

lowed by exports to Canada

and Taiwan, down 30% and

28%, respectively. Monthly

exports to South Korea were

strong, increasing 20% year

over year and setting a re-

cord for the month. December

topped off the fourth-quarter

total at 844 million pounds,

the second-highest total for

the fourth quarter, just over

1% below 2021. Quarterly ex-

ports to South Korea set a re-

cord for the quarter as well,

almost 11% higher year over Are You Tired...

year.

Annual beef exports in

2022 reached a record at of Buying Bulls that Fall Apart?

3.536 billion pounds, a year-

over-year increase of 3%. The

annual value of exports also

set a record at nearly $11 We have Thick, Easy-Fleshing Bulls that are Developed on Fescue!

billion, an increase of more

than 10% over the previous Because of the way our bulls have been bred and developed,

year. Figure 3 shows the

year-over-year changes in they will breed twice as many cows for twice as many years!

export volumes and values

to the top markets. Higher

beef prices bolstered export

values. Exports to China in-

creased nearly 17%, while

the value of those exports in-

creased over 31%. The larg-

est decrease was in exports

to Mexico, continuing a four-

year trend. Exports to Japan

th

were also lower year over Selling on Thursday, April 6 — Springfield, Missouri

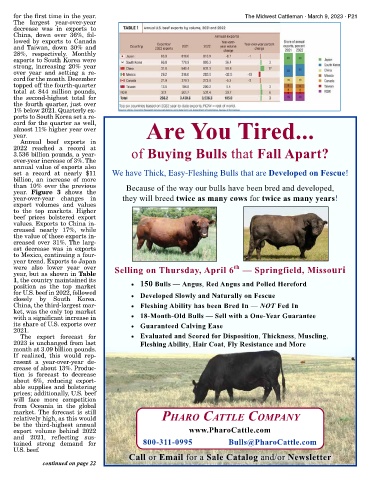

year, but as shown in Table

1, the country maintained its

position as the top market 150 Bulls — Angus, Red Angus and Polled Hereford

for U.S. beef in 2022, followed Developed Slowly and Naturally on Fescue

closely by South Korea.

China, the third-largest mar- Fleshing Ability has been Bred In — NOT Fed In

ket, was the only top market

with a significant increase in 18-Month-Old Bulls — Sell with a One-Year Guarantee

its share of U.S. exports over Guaranteed Calving Ease

2021.

The export forecast for Evaluated and Scored for Disposition, Thickness, Muscling,

2023 is unchanged from last Fleshing Ability, Hair Coat, Fly Resistance and More

month at 3.09 billion pounds.

If realized, this would rep-

resent a year-over-year de-

crease of about 13%. Produc-

tion is forecast to decrease

about 6%, reducing export-

able supplies and bolstering

prices; additionally, U.S. beef

will face more competition

from Oceania in the global

market. The forecast is still

relatively high, as this would PHARO CATTLE COMPANY

be the third-highest annual

export volume behind 2022 www.PharoCattle.com

and 2021, reflecting sus-

tained strong demand for 800-311-0995 Bulls@PharoCattle.com

U.S. beef.

Call or Email for a Sale Catalog and/or Newsletter

continued on page 22