Page 18 - MWC 3-9-2023s

P. 18

The Midwest Cattleman · March 9, 2023 · P18

C

CATTLE REPORT SHOWS ATTLE REPORT SHOWS

SIGNIFIC

SIGNIFICANT HERD ANT HERD

REDUCTIONTION

REDUC

By Russell Knight and Hannah Taylor, Beef Outlook Economists, USDA – ERS

The USDA National Ag- percentage of the beginning

ricultural Statistics Service 2022 beef cow inventory than

(NASS) released its semi-an- during the last drought-in-

nual Cattle report on Jan. 31. duced cattle cycle in 2004-14.

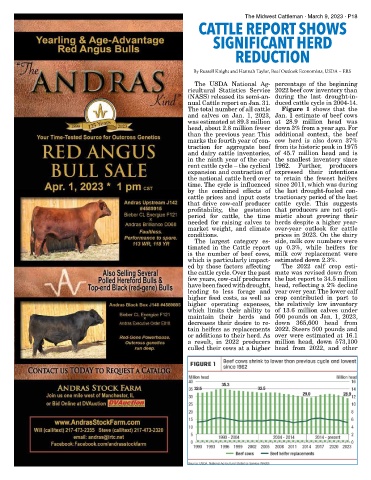

The total number of all cattle Figure 1 shows that the

and calves on Jan. 1, 2023, Jan. 1 estimate of beef cows

was estimated at 89.3 million at 28.9 million head was

head, about 2.8 million fewer down 3% from a year ago. For

than the previous year. This additional context, the beef

marks the fourth year of con- cow herd is also down 37%

traction for aggregate beef from its historic peak in 1975

and dairy cattle inventories, of 45.7 million head and is

in the ninth year of the cur- the smallest inventory since

rent cattle cycle – the cyclical 1962. Further, producers

expansion and contraction of expressed their intentions

the national cattle herd over to retain the fewest heifers

time. The cycle is influenced since 2011, which was during

by the combined effects of the last drought-fueled con-

cattle prices and input costs tractionary period of the last

that drive cow-calf producer cattle cycle. This suggests

profitability, the gestation that producers are not opti-

period for cattle, the time mistic about growing their

needed for raising calves to herds despite a higher year-

market weight, and climate over-year outlook for cattle

conditions. prices in 2023. On the dairy

The largest category es- side, milk cow numbers were

timated in the Cattle report up 0.3%, while heifers for

is the number of beef cows, milk cow replacement were

which is particularly impact- estimated down 2.3%.

ed by those factors affecting The 2022 calf crop esti-

the cattle cycle. Over the past mate was revised down from

few years, cow-calf producers the last report to 34.5 million

have been faced with drought, head, reflecting a 2% decline

leading to less forage and year over year. The lower calf

higher feed costs, as well as crop contributed in part to

higher operating expenses, the relatively low inventory

which limits their ability to of 13.6 million calves under

maintain their herds and 500 pounds on Jan. 1, 2023,

decreases their desire to re- down 365,600 head from

tain heifers as replacements 2022. Steers 500 pounds and

or additions to their herd. As over were estimated at 16.1

a result, in 2022 producers million head, down 573,100

culled their cows at a higher head from 2022, and other