Page 10 - MWC 3-31-2022s

P. 10

UKRAINE The Midwest Cattleman · March 31, 2022 · P10

continued from page 3

through several scenarios. Prices from Bloomberg show of the past few weeks. Last

The immediate impact for Brent Crude and WTI Crude week, May feeder cattle fu-

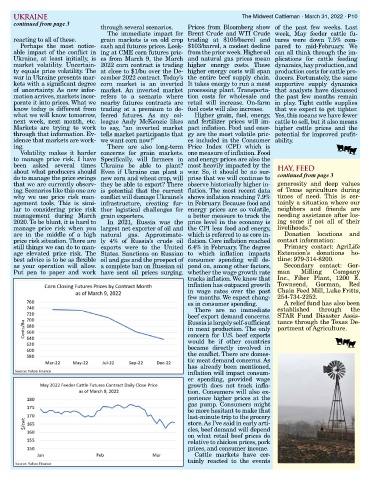

reacting to all of these. grain markets is on old crop trading at $105/barrel and tures were down 7.5% com-

Perhaps the most notice- cash and futures prices. Look- $103/barrel, a modest decline pared to mid-February. We

able impact of the conflict in ing at CME corn futures pric- from the prior week. Higher oil can all think through the im-

Ukraine, at least initially, is es from March 9, the March and natural gas prices mean plications for cattle feeding

market volatility. Uncertain- 2022 corn contract is trading higher energy costs. These dynamics, hay production, and

ty equals price volatility. The at close to $1/bu over the De- higher energy costs will span production costs for cattle pro-

war in Ukraine presents mar- cember 2022 contract. Today’s the entire beef supply chain. ducers. Fortunately, the same

kets with a significant degree corn market is an inverted It takes energy to run a meat supportive supply dynamics

of uncertainty. As new infor- market. An inverted market processing plant. Transporta- that analysts have discussed

mation arrives, markets incor- refers to a scenario where tion costs for wholesale and the past few months remain

porate it into prices. What we nearby futures contracts are retail will increase. On-farm in play. Tight cattle supplies

know today is different from trading at a premium to de- fuel costs will also increase. that we expect to get tighter.

what we will know tomorrow, ferred futures. As my col- Higher grain, fuel, energy, Yes, this means we have fewer

next week, next month, etc. league Andy McKenzie likes and fertilizer prices will im- cattle to sell, but it also means

Markets are trying to work to say, “an inverted market pact inflation. Food and ener- higher cattle prices and the

through that information. Ev- tells market participants that gy are the most volatile pric- potential for improved profit-

idence that markets are work- we want corn now!” es included in the Consumer ability.

ing. There are also long-term Price Index (CPI) which is

Volatility makes it harder concerns for grain markets. one measure of inflation. Food

to manage price risk. I have Specifically, will farmers in and energy prices are also the

been asked several times Ukraine be able to plant? most heavily impacted by the HAY, FEED

about what producers should Even if Ukraine can plant a war. So, it should be no sur-

do to manage the price swings new corn and wheat crop, will prise that we will continue to continued from page 3

that we are currently observ- they be able to export? There observe historically higher in- generosity and deep values

ing. Scenarios like this one are is potential that the current flation. The most recent data of Texas agriculture during

why we use price risk man- conflict will damage Ukraine’s shows inflation reaching 7.9% times of need. This is cer-

agement tools. This is simi- infrastructure, creating fur- in February. Because food and tainly a situation where our

lar to considering price risk ther logistical challenges for energy prices are so volatile, neighbors and friends are

management during March grain exporters. a better measure to track the needing assistance after los-

2020. To be blunt, it is hard to In 2021, Russia was the price level in the economy is ing some if not all of their

manage price risk when you largest net exporter of oil and the CPI less food and energy, livelihoods.”

are in the middle of a high natural gas. Approximate- which is referred to as core in- Donation locations and

price risk situation. There are ly 4% of Russia’s crude oil flation. Core inflation reached contact information:

still things we can do to man- exports were to the United 6.4% in February. The degree Primary contact: AgriLife

age elevated price risk. The States. Sanctions on Russian to which inflation impacts Extension’s donations ho-

best advice is to be as flexible oil and gas and the prospect of consumer spending will de- tline: 979-314-8200.

as your operation will allow. a complete ban on Russian oil pend on, among other factors, Secondary contact: Gor-

Put pen to paper and work have sent oil prices surging. whether the wage growth rate man Milling Company

tracks inflation. We know that Inc., Fiber Plant, 1200 E.

inflation has outpaced growth Townsend, Gorman, Red

in wage rates over the past Chain Feed Mill, Luke Fritts,

few months. We expect chang- 254-734-2252.

es in consumer spending. A relief fund has also been

There are no immediate established through the

beef export demand concerns. STAR Fund Disaster Assis-

Russia is largely self-sufficient tance through the Texas De-

in meat production. The only partment of Agriculture.

concern for U.S. beef exports

would be if other countries

became directly involved in

the conflict. There are domes-

tic meat demand concerns. As

has already been mentioned,

inflation will impact consum-

er spending, provided wage

growth does not track infla-

tion. Consumers will also ex-

perience higher prices at the

gas pump. Consumers might

be more hesitant to make that

last-minute trip to the grocery

store. As I’ve said in early arti-

cles, beef demand will depend

on what retail beef prices do

relative to chicken prices, pork

prices, and consumer income.

Cattle markets have cer-

tainly reacted to the events