Page 12 - MWC 3-31-2022s

P. 12

DROUGHTS declined by 719,000 head last The Midwest Cattleman · March 31, 2022 · P12

continued from page 3 year and these eight states

represented a net loss of sult is the same. Drought al- drought. California just ex-

65% during September. That 484,000 cows, or 67% of the ready threatens the bulk of perienced the driest January

drought, from 2011 to 2013, U.S. total. America’s beef cows in the and February since the Gold

caused America’s beef cow The eight states highlight- heart of ranch country. Rush days of 1849.

herd to decline to its lowest ed here are critical to Amer- Seven states have more That leaves twenty-nine

inventory since 1952. ica’s beef industry – that’s than one million beef cows, states on the map that are

America’s ranchers were where 52% of the nation’s all of them within this cen- east of our central eight. Of

barely recovering from that herd of 30.125 million head tral region. The other two those, only nine states are

historic drought and here we reside. Specifically, 15.655 states in this nine-state re- without drought in the latest

are – facing a similar situa- million beef cows are in the gion, Iowa and North Dako- Drought Monitor, although

tion. eight states singled out here. ta, have at least 945,000 beef only one or two of those twen-

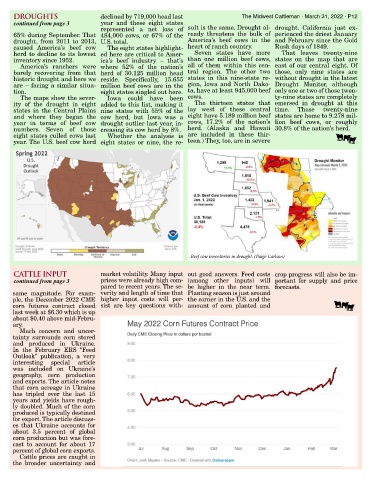

The maps show the sever- Iowa could have been cows. ty-nine states are completely

ity of the drought in eight added to this list, making it The thirteen states that emersed in drought at this

states in the Central Plains nine states with 55% of the lay west of these central time. Those twenty-nine

and where they began the cow herd, but Iowa was a eight have 5.189 million beef states are home to 9.278 mil-

year in terms of beef cow drought outlier last year, in- cows, 17.2% of the nation’s lion beef cows, or roughly

numbers. Seven of those creasing its cow herd by 8%. herd. (Alaska and Hawaii 30.8% of the nation’s herd.

eight states culled cows last Whether the analysis is are included in these thir-

year. The U.S. beef cow herd eight states or nine, the re- teen.) They, too, are in severe

Beef cow inventories in drought. (Paige Carlson)

CATTLE INPUT market volatility. Many input out good answers. Feed costs crop progress will also be im-

continued from page 3 prices were already high com- (among other inputs) will portant for supply and price

pared to recent years. The se- be higher in the near term. forecasts.

same magnitude. For exam- verity and length of time that Planting season is just around

ple, the December 2022 CME higher input costs will per- the corner in the U.S. and the

corn futures contract closed sist are key questions with- amount of corn planted and

last week at $6.30 which is up

about $0.40 above mid-Febru-

ary.

Much concern and uncer-

tainty surrounds corn stored

and produced in Ukraine.

In the February ERS “Feed

Outlook” publication, a very

interesting special article

was included on Ukraine’s

geography, corn production

and exports. The article notes

that corn acreage in Ukraine

has tripled over the last 15

years and yields have rough-

ly doubled. Much of the corn

produced is typically destined

for export. The article discuss-

es that Ukraine accounts for

about 3.5 percent of global

corn production but was fore-

cast to account for about 17

percent of global corn exports.

Cattle prices are caught in

the broader uncertainty and