Page 12 - MWC 9-10-20s

P. 12

THE 2020 when the crisis began impact- The Midwest Cattleman · September 10, 2020 · P12

continued from page 3 ing U.S. Beef Exports. For a

load of 60 head of 800-pound year-over year declines in avoid overwhelming medical

jecting higher U.S. cattle pric- feeder steers, that amounts to beef export volumes to Japan resources until herd immuni-

es during 2020, relative to a decline of $15,840 per truck- (-20.7), South Korea (-39%), ty, or a vaccine could be creat-

2019. A combination of many load unit. Since April 14th, Hong Kong (-11.2%), Taiwan ed. With that said, moving for-

factors (a plateauing U.S. cat- U.S. Feeder Cattle Index Pric- (-37.2), Mexico (-61%), and ward the same risks that were

tle inventory, low corn pric- es have improved by $28 per Canada (-0.2%) for June 2020 present this Spring still exist

es, low U.S. unemployment, hundredweight, or $224 per compared to June 2019. It will today.

strong domestic and export head. For a load of 60 head of be extremely important for ex- • Anytime risk is high, we

beef demand, new trade agree- 800-pound feeder steers, that port volumes to improve over should expect consumer goods

ments, etc.) supported the po- amounts to an improvement the next several months, as to increase in price and raw

tential for higher U.S. cattle of $13,440 per truckload unit. U.S. beef production increas- products to decline (assuming

and beef prices. The improve- If evaluating the change from es during the third and fourth no significant changes in sup-

ment in cattle prices was well January 10th to present (Au- quarters. ply and demand). Why? Be-

documented by Chicago Mer- gust 18th), feeder cattle prices Obviously, there are a num- cause everyone assumes more

cantile Exchange Live Cattle for an 800-pound feeder steer ber of major concerns given risk in the supply chain. Given

and Feeder Cattle Futures have declined $5 per hundred- the current number of busi- that 2020 has seen -$40/barrel

Contracts, USDA Agricultural weight or $40 per head. For a ness closings and the severi- crude oil, a health pandemic,

Marketing Service, CattleFax, load of 60 head of 800-pound ty of unemployment so far in extreme civil unrest in many

and Livestock Market Infor- feeder steers, that amounts to 2020. This will likely make the cities, government mandates

mation Center’s (LMIC) price a decline of $2,400 per truck- consumer the driver of prices to shut down certain business-

forecasts. load. moving forward. For U.S. cattle es, and a collapse in process-

The U.S. Feeder Cattle producers to see an improve- ing capacity in meat packing

Index Price, provided by the What would help Feeder ment in feeder cattle prices in facilities, risk is at a level that

USDA’s Agricultural Market- Cattle Prices stabilize or the short run, there must be has not been seen in our life-

ing Service, is developed from improve? significant improvements in times. No one in the supply

actual sales of feeder cattle Domestic and global beef U.S. economic conditions and chain wants to assume more

via auctions, direct trade, demand has been excellent consumer incomes. Addition- risk right now for the same

video sales, as well as inter- the last several years. This ally, where the product (beef) returns they were receiving

net sales within the 12-state was especially important is sold is extremely important. prior to the pandemic.

region of Colorado, Iowa, Kan- given the huge supplies that Restaurant re-openings and • On July 30, the U.S. Bu-

sas, Missouri, Montana, Ne- were produced from the early improvements in seating ca- reau of Economic Analysis of-

braska, New Mexico, North expansion years. Today, we pacity go a long way in helping ficially confirmed that the U.S.

Dakota, Oklahoma, South are presented with a different to stabilize or improve prices. Economy had entered into a

Dakota, Texas, and Wyoming. challenge as we still have huge High-end restaurants are par- recession. The official number

These prices are a comput- supplies of cattle and beef in ticularly key in order for pre- for the second quarter growth

ed 7-day weighted average the U.S. supply chain for pro- miums to exist for producers rate for real gross domestic

price and provides a proxy for duction in 2020 and 2021. marketing beef cattle. product (GDP) was – 32.9%.

the current U.S. feeder cattle However, our consumers (do- This comes after Real GDP

cash market, based on an 800- mestically and globally) have U.S. Economic Conditions decreased by 5% during the

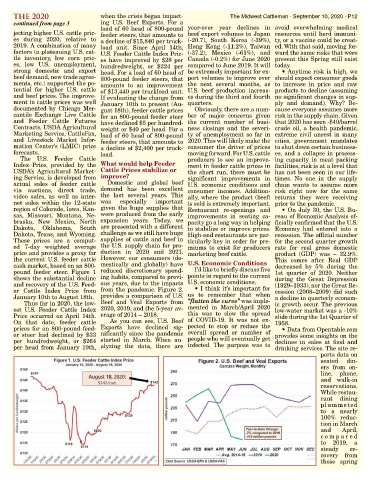

pound feeder steer. Figure 1 reduced discretionary spend- I’d like to briefly discuss five 1st quarter of 2020. Neither

shows the substantial decline ing habits, compared to previ- points in regard to the current during the Great Depression

and recovery of the U.S. Feed- ous years, due to the impacts U.S. economic conditions. (1929–1933), nor the Great Re-

er Cattle Index Price from from the pandemic. Figure 2. • I think it’s important for cession (2008–2009) did such

January 10th to August 18th. provides a comparison of U.S. us to remember that when a decline in quarterly econom-

Thus far in 2020, the low- Beef and Veal Exports from “flatten the curve” was imple- ic growth occur. The previous

est U.S. Feeder Cattle Index 2020, 2019, and the 5-year av- mented in March/April 2020 low-water market was a -10%

Price occurred on April 14th. erage of 2014 – 2018. this was to slow the spread slide during the 1st Quarter of

On that date, feeder cattle As you can see, U.S. Beef of COVID-19. It was not ex- 1958.

prices for an 800-pound feed- Exports have declined sig- pected to stop or reduce the • Data from Opentable.com

er steer had declined by $33 nificantly since the pandemic overall spread or number of provides some insights on the

per hundredweight, or $264 started in March. When an- people who will eventually get declines in sales at food and

per head from January 10th, alyzing the data, there are infected. The purpose was to drinking services. The site re-

ports data on

seated din-

ers from on-

line, phone,

and walk-in

reservations.

While restau-

rant dining

plummeted

to a nearly

100% reduc-

tion in March

and April,

compared

to 2019, a

steady re-

covery from

those spring