Page 13 - MWC 9-10-20s

P. 13

lows has occurred. Data thru each week at levels that can The Midwest Cattleman · September 10, 2020 · P13

August 18, 2020 shows a 55% only be viewed by economists

reduction in diners year-to- as disastrous. An initial claim unemployment claims, at no in substantial economic losses

date, when compared to 2019. is a claim filed by an unem- point in time since the begin- for many U.S. cattle producers.

Additionally, new data from ployed individual after a sep- ning of the collection of this Many of these losses are ongo-

the U.S. Census Bureau indi- aration from an employer. The data set in January 1967 has ing and will likely continue

cates that food and drinking claim requests a determina- initial unemployment claims through 2020. Regardless of

services saw year-to-date sales tion of basic eligibility for the ever begun to approach the when cattle producers market

drop by 21.2% from 2019. This Unemployment Insurance level of claims seen over the their livestock during 2020,

shows that while a recovery is program. Figure 3 looks at past 22 weeks. Prior to 2020, they will likely receive signifi-

occurring from the pandemic’s U.S. weekly initial unemploy- the highest weekly unemploy- cantly lower prices. Actual im-

darkest days thus far, we are ment claims from September ment claim was 695,000 from pacts will certainly vary wide-

still nowhere near back to nor- 2019 – August 2020. the week of October 2, 1982. ly across operations. Producers

mal. A look back. To have a During “The Great Finan- should expect markets to con-

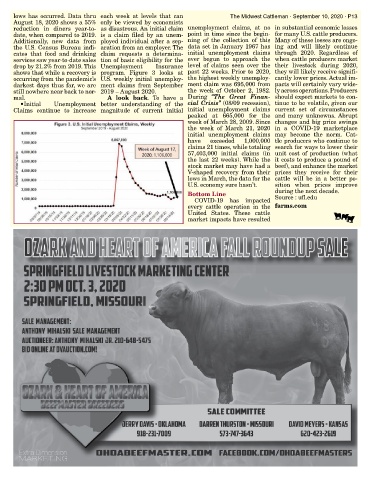

•Initial Unemployment better understanding of the cial Crisis” (08/09 recession), tinue to be volatile, given our

Claims continue to increase magnitude of current initial initial unemployment claims current set of circumstances

peaked at 665,000 for the and many unknowns. Abrupt

week of March 28, 2009. Since changes and big price swings

the week of March 21, 2020 in a COVID-19 marketplace

initial unemployment claims may become the norm. Cat-

have exceeded 1,000,000 tle producers who continue to

claims 21 times, while totaling search for ways to lower their

57,403,000 initial claims (in unit cost of production (what

the last 22 weeks). While the it costs to produce a pound of

stock market may have had a beef), and enhance the market

V-shaped recovery from their prices they receive for their

lows in March, the data for the cattle will be in a better po-

U.S. economy sure hasn’t. sition when prices improve

Bottom Line during the next decade.

COVID-19 has impacted Source : ufl.edu

every cattle operation in the farms.com

United States. These cattle

market impacts have resulted