Page 20 - MWC 10-5-2023s

P. 20

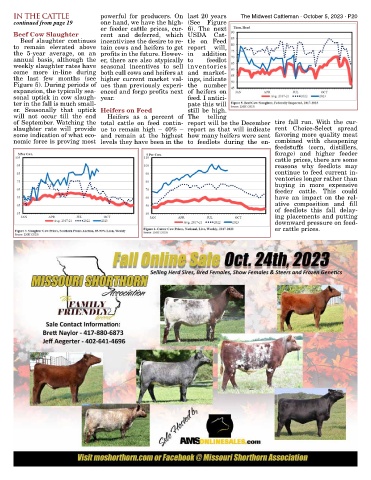

IN THE CATTLE powerful for producers. On last 20 years The Midwest Cattleman · October 5, 2023 · P20

continued from page 19 one hand, we have the high- (See Figure

er feeder cattle prices, cur- 6). The next

Beef Cow Slaughter rent and deferred, which USDA Cat-

Beef slaughter continues incentivizes the desire to re- tle on Feed

to remain elevated above tain cows and heifers to get report will,

the 5-year average, on an profits in the future. Howev- in addition

annual basis, although the er, there are also atypically to feedlot

weekly slaughter rates have seasonal incentives to sell inventories

come more in-line during both cull cows and heifers at and market-

the last few months (see higher current market val- ings, indicate

Figure 5). During periods of ues than previously experi- the number

expansion, the typically sea- enced and forgo profits next of heifers on

sonal uptick in cow slaugh- year. feed. I antici-

ter in the fall is much small- pate this will

er. Seasonally that uptick Heifers on Feed still be high.

will not occur till the end Heifers as a percent of The telling

of September. Watching the total cattle on feed contin- report will be the December tire fall run. With the cur-

slaughter rate will provide ue to remain high – 40% – report as that will indicate rent Choice-Select spread

some indication of what eco- and remain at the highest how many heifers were sent favoring more quality meat

nomic force is proving most levels they have been in the to feedlots during the en- combined with cheapening

feedstuffs (corn, distillers,

forage) and higher feeder

cattle prices, there are some

reasons why feedlots may

continue to feed current in-

ventories longer rather than

buying in more expensive

feeder cattle. This could

have an impact on the rel-

ative composition and fill

of feedlots this fall delay-

ing placements and putting

downward pressure on feed-

er cattle prices.