Page 8 - MWC 04-22-2021s

P. 8

The Midwest Cattleman · April 22, 2021 · P8

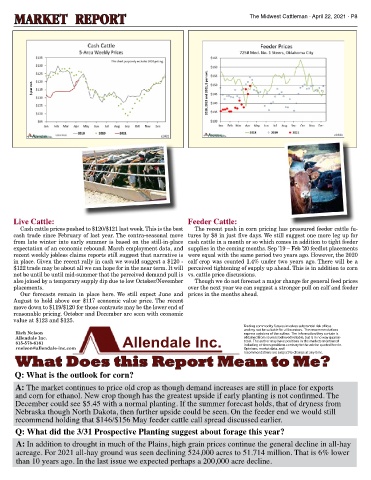

MARKET REPORT

Live Cattle Feeder Cattle Daily

Live Cattle: Feeder Cattle:

Cash cattle prices pushed to $120/$121 last week. This is the best The recent push in corn pricing has pressured feeder cattle fu-

cash trade since February of last year. The contra-seasonal move tures by $8 in just five days. We still suggest one more leg up for

from late winter into early summer is based on the still-in-place cash cattle in a month or so which comes in addition to tight feeder

expectation of an economic rebound. March employment data, and supplies in the coming months. Sep ’19 – Feb ’20 feedlot placements

recent weekly jobless claims reports still suggest that narrative is were equal with the same period two years ago. However, the 2020

in place. Given the recent rally in cash we would suggest a $120 - Feeder Cattle: All you have to do is look at the corn market for a reason for the

Live Cattle: My thoughts center around this market stabilizing now. I’ve been calf crop was counted 1.4% under two years ago. There will be a

placing a bullish tilt to this market for some time now. I may need to temporarily

pull-back in feeders. If I owned a feedlot I’d be nervous to say the least. I do feel

$122 trade may be about all we can hope for in the near term. It will perceived tightening of supply up ahead. This is in addition to corn

the feeder market has overdone it to the downside and it will be tough to break it

place this on “hold” for a while. The higher placements the last three months will

not be until be until mid-summer that the perceived demand pull is vs. cattle price discussions.

have a negative impact on prices yet, so like they say, “All good things come to those

further. The early corn harvest has most feeder buyers in the field and I don’t think

also joined by a temporary supply dip due to low October/November they’ve really had time to concentrate on buying feeders. Let’em get caught up a

Though we do not forecast a major change for general feed prices

who wait”. I see production numbers staying over last years’ levels until at the

placements. little and they’ll head to town.....checkbooks in hand....bulging with “corn” money.

least the end of the year. Beef shipments have been lagging last years’ levels now over the next year we can suggest a stronger pull on calf and feeder

for about a month. Two weeks ago they were 8% lower than last year. This weeks prices in the months ahead.

Our forecasts remain in place here. We still expect June and

This market will rally....wait and see.

report showed exports a whopping 56% lower than last year. This ain’t good. Low

August to hold above our $117 economic value price. The recent

imports and high exports have held this market up all summer. We’re starting to

move down to $119/$120 for those contracts may be the lower end of

lose some of that. I just can’t pull the trigger yet on long term bullish hopes.

reasonable pricing. October and December are seen with economic

value at $123 and $125.

Trading commodity futures involves substantial risk of loss

and my not be suitable for all investors. The recommendations

Rich Nelson express opinions of the author. The information they contain is

Allendale Inc. Allendale Inc. obtained from sources believed reliable, but is in no way guaran-

815-578-6161 teed. The author may have positions in the markets mentioned

including at times positions contrary to the advice quoted herein.

rnelson@allendale-inc.com Opinions, market data, and

recommendations are subject to change at any time.

What Does this Report Mean to Me?

Q #1

Q: What is the outlook for corn?

What do you think the price of fats will be in April 2011

A: The market continues to price old crop as though demand increases are still in place for exports

Answer: It’s hard to see the forest for the trees here, but peering through the foliage I see $105.00 fats on the horizon for April. Demand is

and corn for ethanol. New crop though has the greatest upside if early planting is not confirmed. The

going to have to kick in though in order to get it.

December could see $5.45 with a normal planting. If the summer forecast holds, that of dryness from

Q #2

Nebraska though North Dakota, then further upside could be seen. On the feeder end we would still

Due to the recent break in feeders, would you be holding your fall-weaned

recommend holding that $146/$156 May feeder cattle call spread discussed earlier.

calves for a while or letting them go?

Q: What did the 3/31 Prospective Planting suggest about forage this year?

Answer: What ever happened to the easy questions? This will depend upon your weaning sched-

ule and your available feed supply. I’m long term bullish the feeder market but the “reality” of

A: In addition to drought in much of the Plains, high grain prices continue the general decline in all-hay

right now probably dictates letting them go. If you keep them for an extra 30 days, make sure you

acreage. For 2021 all-hay ground was seen declining 524,000 acres to 51.714 million. That is 6% lower

minimize the grain in the ration. Grow them on good forage....”sell” $4.50 corn. If the fat market

stays sluggish and corn prices don’t moderate, about the only thing you’ve got to hang your hat on

than 10 years ago. In the last issue we expected perhaps a 200,000 acre decline.

for “higher feeders” is “Hope”.

November 6th

Auction

Lunch at 11:00 a.m.

Sale at 12:30

Sale Offering

16 - 2010 Heifer Calves Jan. - May

16 - Breeding Bulls 7 to 18 months RH Standard Lad 0313

16 - Spring Calving Bred Females Solid As A Rock Sire Group

16 - Spring Calving Black Females Reynolds Herefords

Bred to Hereford Bulls

8 - Fall Calving Pairs 1071 County Road 1231

6 - Show Steer Prospects

Both Horned & Polled Offered Huntsville, MO 65259

Home: 660-277-3679 • Matt: 660-676-3788

November 5, 2010 Sale offerings on

Display 3:00 P.M.

CHB Dinner at 6:00 P.M. • Barb: 660-676-4788

Call or E-Mail for Catalog Email: reynoldscattle@cvalley.net