Page 8 - MWC 10-6-2022s

P. 8

The Midwest Cattleman · October 6, 2022 · P8

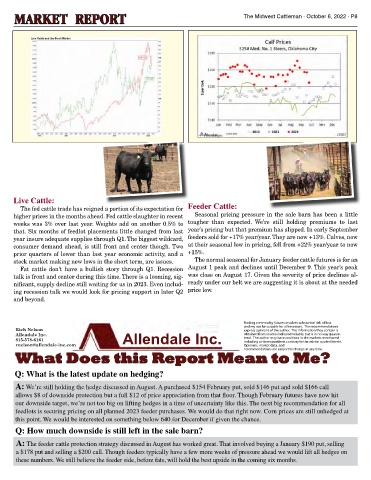

MARKET REPORT

Live Cattle Feeder Cattle Daily

Live Cattle:

The fed cattle trade has reigned a portion of its expectation for Feeder Cattle:

higher prices in the months ahead. Fed cattle slaughter in recent Seasonal pricing pressure in the sale barn has been a little

weeks was 3% over last year. Weights add on another 0.5% to tougher than expected. We’re still holding premiums to last

that. Six months of feedlot placements little changed from last year’s pricing but that premium has slipped. In early September

year insure adequate supplies through Q1. The biggest wildcard, feeders sold for +17% year/year. They are now +13%. Calves, now

consumer demand ahead, is still front and center though. Two at their seasonal low in pricing, fell from +22% year/year to now

prior quarters of lower than last year economic activity, and a +15%.

Live Cattle: My thoughts center around this market stabilizing now. I’ve been

Feeder Cattle: All you have to do is look at the corn market for a reason for the

The normal seasonal for January feeder cattle futures is for an

stock market making new lows in the short term, are issues. pull-back in feeders. If I owned a feedlot I’d be nervous to say the least. I do feel

placing a bullish tilt to this market for some time now. I may need to temporarily

place this on “hold” for a while. The higher placements the last three months will August 1 peak and declines until December 9. This year’s peak

Fat cattle don’t have a bullish story through Q1. Recession

the feeder market has overdone it to the downside and it will be tough to break it

further. The early corn harvest has most feeder buyers in the field and I don’t think

have a negative impact on prices yet, so like they say, “All good things come to those

talk is front and center during this time. There is a looming, sig- was close on August 17. Given the severity of price declines al-

they’ve really had time to concentrate on buying feeders. Let’em get caught up a

who wait”. I see production numbers staying over last years’ levels until at the

nificant, supply decline still waiting for us in 2023. Even includ- ready under our belt we are suggesting it is about at the needed

little and they’ll head to town.....checkbooks in hand....bulging with “corn” money.

least the end of the year. Beef shipments have been lagging last years’ levels now

for about a month. Two weeks ago they were 8% lower than last year. This weeks price low.

ing recession talk we would look for pricing support in later Q2 This market will rally....wait and see.

report showed exports a whopping 56% lower than last year. This ain’t good. Low

and beyond.

imports and high exports have held this market up all summer. We’re starting to

lose some of that. I just can’t pull the trigger yet on long term bullish hopes.

Trading commodity futures involves substantial risk of loss

and my not be suitable for all investors. The recommendations

Rich Nelson express opinions of the author. The information they contain is

Allendale Inc. Allendale Inc. obtained from sources believed reliable, but is in no way guaran-

815-578-6161 teed. The author may have positions in the markets mentioned

including at times positions contrary to the advice quoted herein.

rnelson@allendale-inc.com Opinions, market data, and

recommendations are subject to change at any time.

What Does this Report Mean to Me?

Q #1

Q: What is the latest update on hedging?

What do you think the price of fats will be in April 2011

Answer: It’s hard to see the forest for the trees here, but peering through the foliage I see $105.00 fats on the horizon for April. Demand is

A: We’re still holding the hedge discussed in August. A purchased $154 February put, sold $146 put and sold $166 call

going to have to kick in though in order to get it.

allows $8 of downside protection but a full $12 of price appreciation from that floor. Though February futures have now hit

Q #2

our downside target, we’re not too big on lifting hedges in a time of uncertainty like this. The next big recommendation for all

Due to the recent break in feeders, would you be holding your fall-weaned

feedlots is securing pricing on all planned 2023 feeder purchases. We would do that right now. Corn prices are still unhedged at

calves for a while or letting them go?

this point. We would be interested on something below 640 for December if given the chance.

Answer: What ever happened to the easy questions? This will depend upon your weaning sched-

Q: How much downside is still left in the sale barn?

ule and your available feed supply. I’m long term bullish the feeder market but the “reality” of

right now probably dictates letting them go. If you keep them for an extra 30 days, make sure you

A: The feeder cattle protection strategy discussed in August has worked great. That involved buying a January $190 put, selling

minimize the grain in the ration. Grow them on good forage....”sell” $4.50 corn. If the fat market

a $178 put and selling a $200 call. Though feeders typically have a few more weeks of pressure ahead we would lift all hedges on

stays sluggish and corn prices don’t moderate, about the only thing you’ve got to hang your hat on

these numbers. We still believe the feeder side, before fats, will hold the best upside in the coming six months.

for “higher feeders” is “Hope”.

November 6th

Auction

Lunch at 11:00 a.m.

Sale at 12:30

Sale Offering

16 - 2010 Heifer Calves Jan. - May

16 - Breeding Bulls 7 to 18 months RH Standard Lad 0313

16 - Spring Calving Bred Females Solid As A Rock Sire Group

16 - Spring Calving Black Females Reynolds Herefords

Bred to Hereford Bulls

8 - Fall Calving Pairs 1071 County Road 1231

6 - Show Steer Prospects

Both Horned & Polled Offered Huntsville, MO 65259

Home: 660-277-3679 • Matt: 660-676-3788

November 5, 2010 Sale offerings on

Display 3:00 P.M.

CHB Dinner at 6:00 P.M. • Barb: 660-676-4788

Call or E-Mail for Catalog Email: reynoldscattle@cvalley.net